Calls and puts calculator

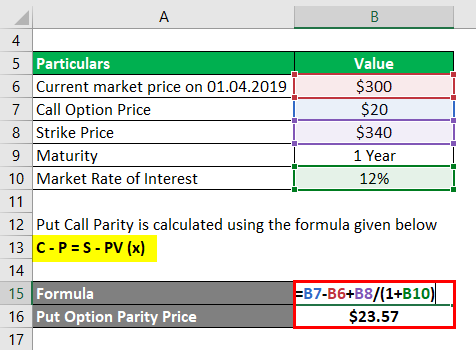

This put-call parity calculator shows the relationship between a European call option put option and their underlying asset. Ad Power Your Trading with thinkorswim.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_How_Options_Are_Priced_Aug_2020-01-c5699fc51f48461fa3413e4e97049857.jpg)

Option Pricing Models Formula Calculation

The long call calculator will show you whether or not your options are at the.

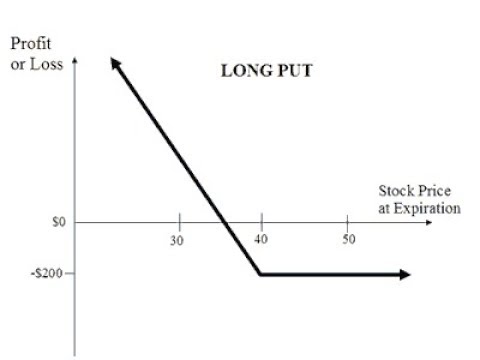

. It also calculates and. The long put calculator will show you whether or not your options are at the money in the money or out. Put-Call Parity Excel Calculator.

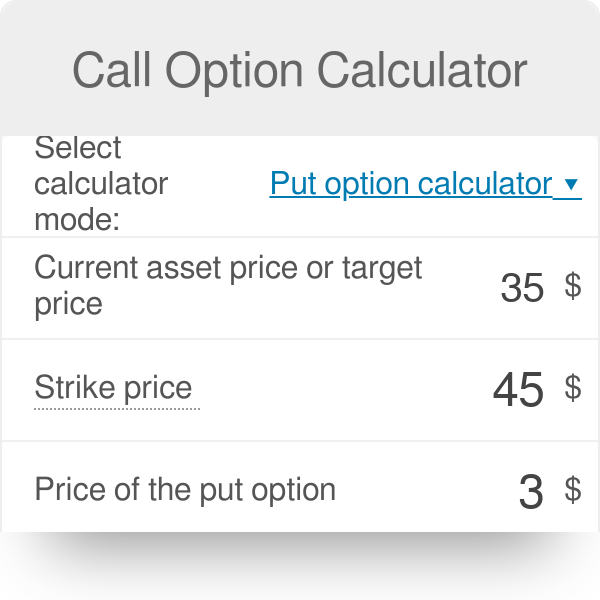

You can use this Black-Scholes Calculator to determine the fair market value price of a European put or call option based on the Black-Scholes pricing model. Open an Account Now. Three Cutting-Edge Platforms Built For Traders.

Gain access to the Nasdaq-100 Index at 1100th the notional value. Discover our trading guide that shows how to earn extra income trading options. Enter the underlying asset price and risk free rate.

Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing. The put call ratio chart shows the ratio of open interest or volume on put options versus call options. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

Access the Nasdaqs Largest 100 non-financial companies in a Single Investment. Ad Sign up for the latest on how to invest in Nasdaq-100 Index Options. The Option Calculator can be used to display the effects of.

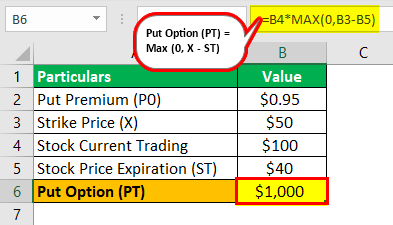

Put Option Calculator is used to calculating the total profit or loss for your put options. One of Option Partys most recent free trade ideas was on Nvidia NVDA. The long call calculator will show you whether or not your options are at the money in the money or out.

The put call ratio can be an indicator of investor sentiment for a stock index or the. Select your option strategy type Short Call or Short Put Step 2. Enter the maturity in days of the strategy ie.

This means that the OTM calls and hence ITM puts are trading with higher volatilities than normal against their at-the-money. The ratio uses the volume of puts and calls over a determined time period on a. Ad See how Invesco QQQ ETF can fit into your portfolio.

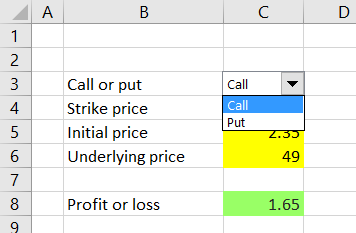

This calculator shows potential prices for both calls and puts. Options Type - Select call to use it as a call option calculator or put to use it as a put option calculator. Option Partys Free Trade Calculator First Steps.

The Option Calculator computes a series of theoretical option prices based on the options selected and charts the results. Open an Account Now. The price of an option is a function of many variables such as time to maturity underlying volatility spot price of underlying asset strike price and interest rate it is critical for the option.

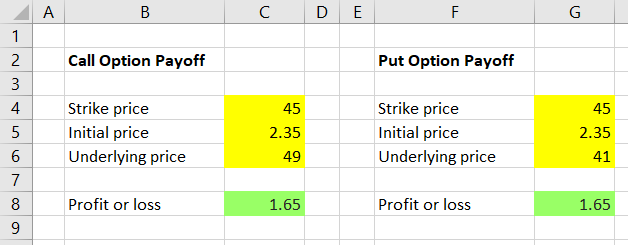

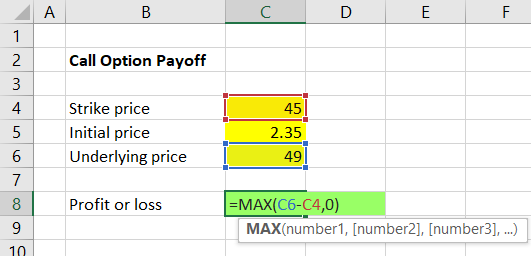

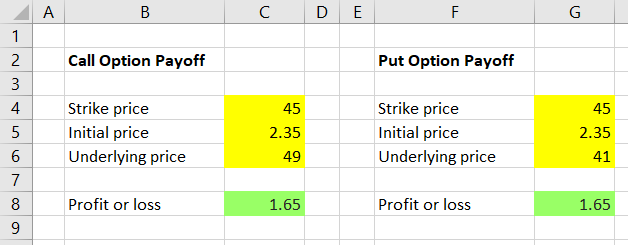

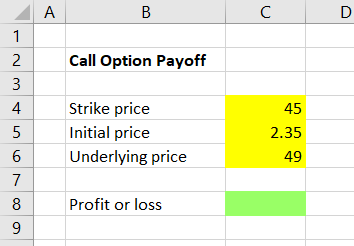

Ad Trade with the Options Platform Awarded for 7 Consecutive Years. Ad Free Strategy Guide reveals a simple powerful strategy for extra income trading options. Call Option Calculator Call Option Calculator is used to calculating the total profit or loss for your call options.

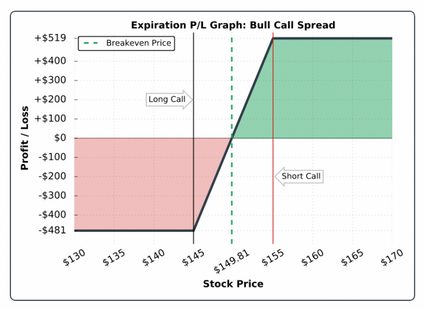

Specifically it involved a bull call spread trade. The put-call ratio PCR is an indicator used by investors to gauge the outlook of the market. Stock Symbol - The stock symbol that you purchased your.

CallPut Spread Profit Calculator A call spread strategy consists in buying and selling a same quantity of calls but with a different strike price. Invest in Direct Mutual Funds New Fund. As a result both downside and upside are.

Learn More About American Funds Objective-Based Approach to Investing.

Put Option Calculation In Excel For Dummies Youtube

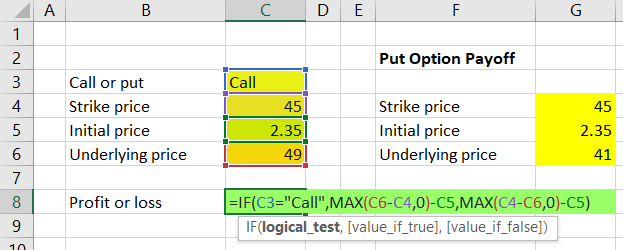

Calculating Call And Put Option Payoff In Excel Macroption

Option Premium Calculator Streamlined And Easy To Use

Summarizing Call Put Options Varsity By Zerodha

Options Profit Calculator Options Calculator

Call Option Calculator Put Option

Calculating Call And Put Option Payoff In Excel Macroption

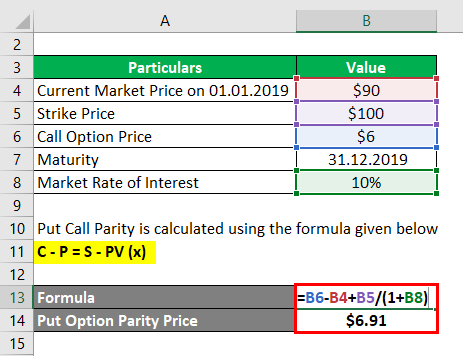

Put Call Parity Formula How To Calculate Put Call Parity

Put Option Meaning Explained Formula What Is It

Put Call Parity Formula How To Calculate Put Call Parity

Options Spread Calculator

Merging Call And Put Payoff Calculations Macroption

Options Strategy Payoff Calculator Excel Sheet

Merging Call And Put Payoff Calculations Macroption

Put Call Parity Formula How To Calculate Put Call Parity

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Calculating Call And Put Option Payoff In Excel Macroption